reichbaum.ru Prices

Prices

Converting 401 K To Ira

Roll over your old (k) or (b) to a Vanguard IRA to gain investment flexibility without losing tax benefits. Give your money a fresh start today! An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. If your (k) administrator allows it, you can convert a portion of your funds to a Roth IRA and a portion to a traditional IRA to split the tax liability. Specifically, you will be able to transfer a. k to a rollover IRA (employer permitting) and then transfer the IRA to a Canadian RRSP. Leave k/IRA. If you. Step 2 — Transfer funds from your old QRPExpand · Ask to roll over the funds directly to Wells Fargo for benefit of (FBO) your name. · Reference both your name. Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. If a direct rollover isn't an option, you can use an indirect rollover. Your (k) administrator will send a check made out to you for the balance of your. You can roll a (K) into an IRA in two ways: through a direct rollover or an indirect rollover. Let us clarify direct vs. indirect rollovers. Roll over your old (k) or (b) to a Vanguard IRA to gain investment flexibility without losing tax benefits. Give your money a fresh start today! An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. If your (k) administrator allows it, you can convert a portion of your funds to a Roth IRA and a portion to a traditional IRA to split the tax liability. Specifically, you will be able to transfer a. k to a rollover IRA (employer permitting) and then transfer the IRA to a Canadian RRSP. Leave k/IRA. If you. Step 2 — Transfer funds from your old QRPExpand · Ask to roll over the funds directly to Wells Fargo for benefit of (FBO) your name. · Reference both your name. Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. If a direct rollover isn't an option, you can use an indirect rollover. Your (k) administrator will send a check made out to you for the balance of your. You can roll a (K) into an IRA in two ways: through a direct rollover or an indirect rollover. Let us clarify direct vs. indirect rollovers.

But there's another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a. Employer Stock: If you have employer stock in your k that has appreciated in value a lot, rolling it over to an IRA may come with negative. SEP-IRA. Governmental. (b). Qualified. Plan1. (pre-tax). (b). (pre-tax) plans include, for example, profit-sharing, (k), money purchase, and. We can help you move over a (k) or other eligible retirement account(s) into an Individual Retirement Account (IRA) at J.P. Morgan Wealth Management. Get. You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the day rollover. The Benefits Of Converting Your (k) Into A Rollover IRA · 1) More selection of investments. · 2) Lower costs. · 3) Fewer trading restrictions. · 4) Less tax. How do I roll over to a Prudential IRA? In three simple steps: Open a Prudential IRA. Contact the record keeper of your old employer-sponsored retirement plan. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k). Roll over old ks or IRAs to T. Rowe Price to simplify your retirement savings. We'll work with your current provider to handle most of the paperwork. A (k) rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA— this is why it's also called a Rollover IRA. This option is. The Bottom Line. When you leave a job, you can leave your (k) where it is, roll it over into your new employer's (k) plan, roll it over into an IRA, or. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into. A rollover is when you move funds from one eligible retirement plan to another, such as from a (k) to a Traditional IRA or Roth IRA. Rollover distributions. INVESTING GOALSExplore rolling over your (k) We can help you move over a (k) or other eligible retirement account(s) into an Individual Retirement. IRS rules limit you to one rollover per client per twelve month period. For more information on rolling over your IRA, (k), (b) or SEP IRA, visit Should I. Steps to roll over k to IRA · Find an IRA investment appropriate for you (such as an annuity, a bank CD, or a mutual fund). · Contact the administrator of. Roll over your (k) to a Traditional or Roth IRA with SoFi and get low fees, diversified portfolios, and complimentary financial planning. There are no tax implications for rolling a k into a traditional IRA. You can do it any time, and if you aren't happy with the investment. plans include, for example, profit-sharing, (k), money purchase, and For more information regarding retirement plans and rollovers, visit Tax Information. Rolling over a (k) into a new or existing traditional or Roth IRA is just one option to consider. Options include roll it, leave it, move it, or take it.

Trade My Car With No Down Payment

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Some drivers may be wondering, “Can you buy a used car with no money down?” The answer is yes! Between our diverse inventory of zero-down vehicles and expert. While it is possible to trade in a car you're still paying on, you need to remember that you will still be on the hook to pay off the existing balance. A big plus to securing a no down payment loan is the ability to trade a car in. vehicle let alone the vehicle of my choice! It was from the greeting to. How Can I Get a Car with No Down Payment? Zero Down? Getting a family member or a friend with a strong credit score to cosign your loan can be very beneficial. Can I trade in my car that's not paid off? Yes. Trading in a financed no money down lease specials may be your best option. Check out our current. We can provide you with a loan without a down payment, so you simply need to agree to a loan and you'll be set. Meet with Our Finance Team. When you're ready to. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. What is My Vehicle Worth? Use your trade-in as a down payment on your next car, truck, or SUV. Below is just a few factors that play into the value of your. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Some drivers may be wondering, “Can you buy a used car with no money down?” The answer is yes! Between our diverse inventory of zero-down vehicles and expert. While it is possible to trade in a car you're still paying on, you need to remember that you will still be on the hook to pay off the existing balance. A big plus to securing a no down payment loan is the ability to trade a car in. vehicle let alone the vehicle of my choice! It was from the greeting to. How Can I Get a Car with No Down Payment? Zero Down? Getting a family member or a friend with a strong credit score to cosign your loan can be very beneficial. Can I trade in my car that's not paid off? Yes. Trading in a financed no money down lease specials may be your best option. Check out our current. We can provide you with a loan without a down payment, so you simply need to agree to a loan and you'll be set. Meet with Our Finance Team. When you're ready to. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. What is My Vehicle Worth? Use your trade-in as a down payment on your next car, truck, or SUV. Below is just a few factors that play into the value of your.

A big plus to securing a no down payment loan is the ability to trade a car in. vehicle let alone the vehicle of my choice! It was from the greeting to. Our trade-in offer carries no obligation. Once we tell you what we're willing to pay for your car, you can accept the offer and apply your trade-in value. If you want to be rid of your vehicle but will need a new vehicle to replace it within quick succession, it is more advisable to continue making your payments. Yes, you can trade in a financed car, but you still have to pay off the remaining loan balance. However, this is not as intimidating as it sounds. There are ways to get a car with no money down while getting lower rates, such as by getting co-signer, increasing your credit score, and negotiating the terms. The dealer will purchase the car and pay off the loan, then they'll put what's left toward the new vehicle price, giving you a major advantage. If you have. Previous Vehicle Payment History. Previous vehicle payment history is a strong factor in no money down approvals. · Low Credit Scores Due To Credit Reporting. Do you need a new car but are worried about your bad credit or having a huge down payment? Worry no more when you come to Nissan of Streetsboro Ohio. We. Leasing is a great choice for shoppers who like to drive a new vehicle and want to keep their payments low. Once your lease term is up, you can trade up for a. But trading in your car doesn't make your loan disappear. You will still have to pay off the remaining loan balance that your trade-in amount doesn't cover. 3. No, you cannot do that. The down payment is your property (cash or car or) that you give to the dealer. The car you are buying/. A common question we encounter is "will a dealership buy my car if I still owe?" It is definitely possible to trade in even if you are still paying your auto. We offer zero down loans to our customers undergoing bankruptcy (7 & 13)*. If you are planning on including your current vehicle in the bankruptcy, we can help. How Can I Get a Car with No Down Payment? Zero Down? Getting a family member or a friend with a strong credit score to cosign your loan can be very beneficial. Can I Trade In a Car With Negative Equity? If you're interested in trading in your upside-down car, some dealerships will offer to pay off the loan for you. That's why we offer a wide range of zero down lease offers or $0 down car financing to help you drive away in the car of your dreams. Visit our Nissan dealer. Do Bad Credit Auto Loans have higher interest rates? How much will I get pre-approved for? How much money will I need for a down payment? Can I use my trade-. This is because your loan doesn't just disappear when you trade in your vehicle. It still needs to be paid off. If the value of the car is higher than what you. Can you trade in a car you still owe on? You can with a dealership. If you're upside down on your car loan, you can consolidate what's owed on your current car.

Walmart Return Items

Items sold and shipped by Walmart can be returned or replaced, when available, by mail within 90 days of receipt. For items sold by Marketplace. According to the suit, generally, Walmart provides that customers who comply with its return policy are entitled to reimbursement of the full purchase price. Items shipped by Walmart can be returned or replaced, when available, by mail within 90 days of receipt. For items shipped by Marketplace Sellers, find. Bottom line While there may be some exceptions, Walmart does have a good day return policy for most qualifying items bought by Walmart shoppers. This. In most cases, you have 90 days to return items purchased from Walmart. Return window exceptions might include: Major appliances 2 days. Good to know: Along with your returned item, we will also refund any tax and environmental fee. We will also refund any associated shipping charge for defective. We refund reichbaum.ru returns submitted in-store or by mail to your original method of payment. Outbound shipping charges aren't always refunded upon return. You have 90 days after purchase to exchange or return, unless noted in our exceptions. You can return items in-store, for free by mail, or via a scheduled. Most Marketplace items may be returned within 30 days, below are the exceptions: · New and preowned apparel above $ · Fine art · Loose gems and gemstones. Items sold and shipped by Walmart can be returned or replaced, when available, by mail within 90 days of receipt. For items sold by Marketplace. According to the suit, generally, Walmart provides that customers who comply with its return policy are entitled to reimbursement of the full purchase price. Items shipped by Walmart can be returned or replaced, when available, by mail within 90 days of receipt. For items shipped by Marketplace Sellers, find. Bottom line While there may be some exceptions, Walmart does have a good day return policy for most qualifying items bought by Walmart shoppers. This. In most cases, you have 90 days to return items purchased from Walmart. Return window exceptions might include: Major appliances 2 days. Good to know: Along with your returned item, we will also refund any tax and environmental fee. We will also refund any associated shipping charge for defective. We refund reichbaum.ru returns submitted in-store or by mail to your original method of payment. Outbound shipping charges aren't always refunded upon return. You have 90 days after purchase to exchange or return, unless noted in our exceptions. You can return items in-store, for free by mail, or via a scheduled. Most Marketplace items may be returned within 30 days, below are the exceptions: · New and preowned apparel above $ · Fine art · Loose gems and gemstones.

Almost anything you buy from Walmart, whether purchased in-store or on reichbaum.ru (that are fulfilled by Walmart), can be returned or replaced within 90 days. Coupons will not be given back upon return of the merchandise. Walmart reserves the right to decline the return of items purchased with manufacturer coupons. Most unwanted or defective products can be returned to Walmart within 90 days, with or without a receipt. This applies to online purchases as well as in-store. Does Walmart accept returned items pass 90 days? Oddly enough your best bet is to try and return it without a receipt. There usually is nothing on the product. Start an Online Return · Walmart Standard Return Policy · Walmart Marketplace Return Policy · Walmart Marketplace Return Policy – Return Restrictions. Return to a Walmart store: For most items, print the barcode displayed on the screen or take your return email with you to return your item to the store. Walmart's return policy allows customers to return most items within 90 days of purchase for a refund or exchange. This applies to items purchased both . If you are returning anything to the store, you must bring the item, anything included with the item, and your store receipt. The item must be. You can download a “Return Item Overrides Report” from your Walmart channel through StoreAutomator. This report is downloaded directly. You can return nearly everything Walmart Business sells. Your purchase history displays the latest eligible date for a return or replacement. We recommend. Some MP items aren't eligible for return to a Walmart store. These are typically items that are Hazmat items may have mail back restrictions. The associate will bring your item back to the store for a refund. To schedule an InHome return pickup: When you're logged into reichbaum.ru select Account. I started a return via the Walmart app and was under the impression that I had to go back to the same store to finalize things. All items are assigned with a day return window by default but you may offer even up to 90 days for selected categories. Walmart returns that don't suck. Never miss a return deadline again. Never leave your house to make a return again. That's the power of Orderly. No matter what your reason is, U.S. customers can return items up to 90 days from the shipping date— free! For non-contact lens orders, please visit Walmart. You can return clothes, shoes, jewelry, etc. within 90 days for a full refund if you have the receipt. If you don't have the receipt, you can get a store credit. You're able to return or replace items purchased in store at your nearest Walmart store within 90 days of receipt. To ensure your in-store item may be returned. Your refund will be issued right after we process your return. We process all returns within 24 hours of collecting your items, but your refund may not show up. Walmart's Day Return Policy doesn't apply to all of its items, and some items need to be returned within 14, 30, and 60 days of purchase.

How To Put Your Rent Money In Escrow

How can a tenant start a rent escrow? · Tenant decides to start escrow: The tenant reasonably believes that the landlord is breaching its duties under law or the. You must give your Landlord a written "Notice to Remedy Conditions." The written notice must be delivered to your landlord at least 30 days before you put any. When it is approved, bring your rent money to the court and they will put it into a special account set aside for rent escrow. ¼. Be sure to get a receipt for. Ohio law does not allow you to put your rent in escrow if your landlord only I want the rent money I put into escrow to be released to me so I can make. escrow but under the current law, may have their request denied. Until , the law was clear. If tenants decided to withhold rent, they had to put it in. If your landlord makes the repairs, you can go to the court and sign a release form. This will allow the court to release your rent money to your landlord. I'll need to place the money in an escrow so that when we go to housing court I can prove that we intend to pay should the problem be rectified. Before you pay your rent to the court, you must write your landlord a second letter stating that you are going to pay your rent into escrow if the repairs are. Come to the Clerk of Courts, Rent Escrow office with your ID to sign a release form that authorizes the escrowed funds to be released to your landlord. Rent is. How can a tenant start a rent escrow? · Tenant decides to start escrow: The tenant reasonably believes that the landlord is breaching its duties under law or the. You must give your Landlord a written "Notice to Remedy Conditions." The written notice must be delivered to your landlord at least 30 days before you put any. When it is approved, bring your rent money to the court and they will put it into a special account set aside for rent escrow. ¼. Be sure to get a receipt for. Ohio law does not allow you to put your rent in escrow if your landlord only I want the rent money I put into escrow to be released to me so I can make. escrow but under the current law, may have their request denied. Until , the law was clear. If tenants decided to withhold rent, they had to put it in. If your landlord makes the repairs, you can go to the court and sign a release form. This will allow the court to release your rent money to your landlord. I'll need to place the money in an escrow so that when we go to housing court I can prove that we intend to pay should the problem be rectified. Before you pay your rent to the court, you must write your landlord a second letter stating that you are going to pay your rent into escrow if the repairs are. Come to the Clerk of Courts, Rent Escrow office with your ID to sign a release form that authorizes the escrowed funds to be released to your landlord. Rent is.

Before you can put your rent into escrow, you must: · Give your landlord written notice of all the repairs needed. It's best to make one list containing all of. In a rent escrow case, a tenant is usually required to pay rent directly to the court. The court will hold the tenant's money until the conclusion of the case. You may be able to pay your rent into a separate bank account. This is called paying in escrow. To do this, call your bank and ask to set up an escrow account. Make sure to get a receipt, particularly if you pay in cash. Keep track If you escrow or withhold your rent, you must do the following: Notify your. To enroll in escrow, the applicant must complete an application and attach the necessary documents (rental documents, utility bills, and photo ID) online. penalty because your landlord has failed to make repairs. The court may also distribute some or all of the money in rent escrow, without stopping the account. If your landlord makes the repairs, you can go to the court and sign a release form. This will allow the court to release your rent money to your landlord. If approved by the court, tenants pay rent into an escrow account until a landlord makes repairs. If you have questions, get help. Tenants and non-business. Courts in Ohio do different things at this point. Some courts will take your money with the application and put it into a special account set aside for rent. Before you can put your rent into escrow, you must: · Give your landlord written notice of all the repairs needed. It's best to make one list containing all of. Deposit any rent that is owed with the court. Personal checks are not accepted. Cash or cashier's check is acceptable. Check with the Court Administrator/. Call or check your municipal court's website. Look or ask for the court's rent escrow application. Make sure you find out what types of payment the court. Tenant must complete the "Application and Affidavit for Tenant Rent Escrow” form at the time the rent money is deposited into escrow. This form asks some. You can use an escrow company or an attorney. The money is deposited into a trust account and neither party can access the money until the terms of the. Rent Escrow · Fill in your name where it says “I, __(tenant's name)___ state that ” · Fill in your monthly rent amount. · Fill in your next rental payment due date. In reality, it's more complicated than that: In many states, you have to deposit the withheld rent with a court, a neutral third party, or an escrow account set. Court Rent Escrow Department with your. ID to sign a release form that authorizes the escrowed funds to be released to your landlord. Pay your rent directly to. If tenants decided to withhold rent, they had to put it in escrow. When After a months-long trial, the money may have been spent. Mandatory escrow. You must give the landlord proper notice and adequate time to make the repairs before you have the right to place rent in escrow. The escrow account can only be. To deter them, show the bank statement of your escrow account to your landlord to demonstrate that you have the money but refuse to pay until repairs are made.

Best Way To Build Stock Portfolio

Some different investment portfolio examples include mutual funds, exchange-traded funds (ETFs) and index funds. These are all great ways to introduce. Mutual funds or exchange-traded funds (ETFs) are often a great way to gain access to a wide range of asset classes. Stocks provide growth potential, but can be. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. Building a profitable investment portfolio isn't complicated - as long as you set realistic investment goals. In most cases, diversification turns out to be a. Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a balance between stretching. But how exactly can you build one? Read on to learn more about different types of portfolios, why diversifying can be a good idea and how you can start building. How To Build a Stock Portfolio · 3. Pay to Read Stuff from Folks More Focused Than You · 8. Think Probabilistically · 9. Buy in Pieces · Sell Your Losers (and. Once you have decided how much of each asset class you'd like to invest in, the next step is to choose the specific shares of assets that will be in each of. The purpose of combining different asset classes is to be better prepared for various market conditions in an effort to provide more consistent, less rocky. Some different investment portfolio examples include mutual funds, exchange-traded funds (ETFs) and index funds. These are all great ways to introduce. Mutual funds or exchange-traded funds (ETFs) are often a great way to gain access to a wide range of asset classes. Stocks provide growth potential, but can be. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. Building a profitable investment portfolio isn't complicated - as long as you set realistic investment goals. In most cases, diversification turns out to be a. Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a balance between stretching. But how exactly can you build one? Read on to learn more about different types of portfolios, why diversifying can be a good idea and how you can start building. How To Build a Stock Portfolio · 3. Pay to Read Stuff from Folks More Focused Than You · 8. Think Probabilistically · 9. Buy in Pieces · Sell Your Losers (and. Once you have decided how much of each asset class you'd like to invest in, the next step is to choose the specific shares of assets that will be in each of. The purpose of combining different asset classes is to be better prepared for various market conditions in an effort to provide more consistent, less rocky.

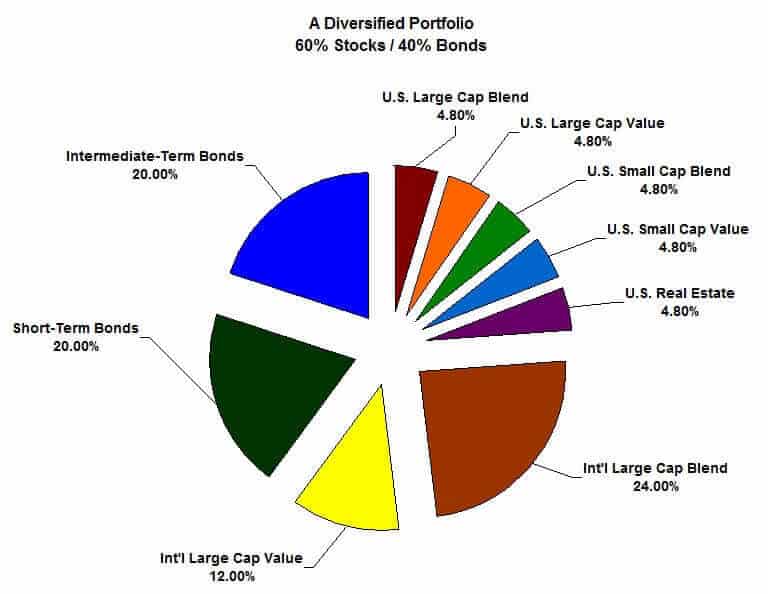

For example, if your asset allocation involves having 60% of your money in stocks or equities, you should diversify your portfolio to include foreign and. One of the first steps in investing is building a portfolio that's right for your situation. A portfolio is a mix of stocks, bonds and cash. How to build your investment portfolio · Identify the different elements of a diversified portfolio · Invest in funds · Diversify even within the same asset class. Step 1: Determining Your Appropriate Asset Allocation · Step 2: Achieving the Portfolio · Step 3: Reassessing Portfolio Weightings · Step 4: Rebalancing. Do you want to build your own stock portfolio? Here are 13 not-so-easy components you should consider. Investing doesn't have to be complicated or costly to be successful; simple & inexpensive is most effective. I invest % in total-market. How you divide your total portfolio into stocks, bonds and cash investments will influence your total returns greatly. Over the long-term, stocks have provided. Know your objectives · Choose the right level of risk · Select your investments within each asset · Rebalance your portfolio and review your strategy. An all-ETF portfolio means giving up actively managed mutual funds, which have the potential to outperform index ETFs through professional selection of stocks. How To Build An Investment Portfolio: 6 Important Steps · Determine your risk tolerance and investment time horizon · Decide how active you want to be · Choose an. One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies. The key to building a sustainable stock portfolio is diversification. In other words, you'd spread your money across several: Stocks; Industries; Asset types. Diversify your portfolio. No matter how well a stock might be doing at the moment, the price and value of stocks are bound to fluctuate. Diversifying your. How to Build a Stock Portfolio in the Stock Market · 1. Your goals. Determining your goals is the first step to creating a stock portfolio. · 2. Asset allocation. 1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. However, this is not usually the best way to build a smart portfolio. Instead, seek out a wide range of stocks from different industries, and also diversify. Growth portfolios are designed to build up an increase in returns over time, through individual stocks growing in value and through the reinvestment of. The first factor is where you're at in your investor life stage – early investing years, good earnings years, higher income and savings years, early retirement. 7 clever and reliable stock market investing tips: · Avoid the risk of ruin · Invest in what you care about · Be humble & try to learn from your. Set Clear Goals:Define your financial goals, such as retirement, buying a home, or funding education. Your goals will influence your investment.

Can You Use An Ira As Collateral For A Loan

/GettyImages-955530262-5bd87bb1c9e77c00518d6332.jpeg)

The only “recourse” the lender may use to collect on the default is the collateral. While you could lose your collateral, your remaining assets are protected. You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. If you were able to secure the loan with collateral or other assets, then this would allow you to keep any property that was used as collateral in addition to. The securities within your accounts serve as a source of collateral for the loan. You can anticipate borrowing rates of up to % of the value of your. You can use a non-purpose securities-based line of credit, such as you use a loan secured by your Wells Fargo Advisors account assets as collateral. Secured loans typically use real estate as collateral for a private mortgage. However, the IRA can also use other assets like automobiles, private stock, and. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. Yes, you can absolutely use your SDIRA to loan money to others. In fact, it's one of the only retirement accounts of its kind that enables investors to loan. The only “recourse” the lender may use to collect on the default is the collateral. While you could lose your collateral, your remaining assets are protected. You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. If you were able to secure the loan with collateral or other assets, then this would allow you to keep any property that was used as collateral in addition to. The securities within your accounts serve as a source of collateral for the loan. You can anticipate borrowing rates of up to % of the value of your. You can use a non-purpose securities-based line of credit, such as you use a loan secured by your Wells Fargo Advisors account assets as collateral. Secured loans typically use real estate as collateral for a private mortgage. However, the IRA can also use other assets like automobiles, private stock, and. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. Yes, you can absolutely use your SDIRA to loan money to others. In fact, it's one of the only retirement accounts of its kind that enables investors to loan.

As such, an IRA or k must obtain a non-recourse mortgage. In this type of loan, you are not utilizing your credit to qualify and are not pledging your. Clients that utilize an eligible IRA account balance to qualify for certain discounts may qualify for one special IRA benefit package per loan. This. The Internal Revenue Service (IRS) does not allow you to borrow money from your Simplified Employee Pension Individual Retirement Account (SEP IRA) or to use. The only problem is that your IRA funds don't cover the entire price. What's an investor to do? This is a common scenario and the IRS allows you to take out a. could have broader borrowing options by using their own assets as collateral. But doing so exposes those assets to increased risk, so you've got to have the. Sometimes referred to as a Secured Personal Loan or a Passbook Loan, this type of loan allows you to borrow money using the funds in your deposit account as. Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts ((k) accounts) are acceptable sources. While you cannot take a loan from your IRA, you can make an indirect rollover. IRA rollovers are common. For example, you might close out one retirement account. You are protected as well as your IRA, so the lender cannot take anything from you, with the exception of your collateral. 5png-5e5fc1f5f2b In. If you need temporary liquidity, borrowing against the value of your home or securities can offer an alternative to selling securities. · Some methods of. As such, an IRA or k must obtain a non-recourse mortgage. In this type of loan, you are not utilizing your credit to qualify and are not pledging your. To lend money with your Self-Directed IRA, you will issue a secured or unsecured promissory note, mortgage or deed of trust. In order to complete the loan. There are two types of loans you may be eligible for, depending on your employer's plan: a Retirement Plan Loan or a Collateralized Loan. If you're eligible for. Withdraw up to $10, of investment earnings from an IRA for a first-time home purchase If you're younger than years old, you still have a way to. A decline in the value of your collateral assets may require you to provide additional funds or securities to avoid a collateral maintenance call. You can lose. Use your self-directed IRA to purchase real estate with a non-recourse loan. We offer a unique financing program for the purchase of property with a real. To lend money with your Self-Directed IRA, you will issue a secured or unsecured promissory note, mortgage or deed of trust. In order to complete the loan. How to use your Self-Directed IRA to Invest in Secured and Unsecured Notes. Private lending, including secured notes like mortgages with real estate. IRS Tax Code and Using an IRA as Collateral. The primary reason retirement account investors don't typically borrow cash (also called debt or leverage) to. If your SDIRA purchases a property using a non-recourse loan, the debt financing transaction will subject the IRA to unrelated debt-financed income (UDFI).

Best Roof Solar Panels

The size, shape, and slope of your roof are also important factors to consider. Typically, solar panels perform best on south-facing roofs with a slope. Sparks solar is one of the leading solar companies in India. They produce the best solar panels for home in India market at very low cost. Spark has the best. Typically, solar panels perform best on south-facing roofs with a slope between 15 and 40 degrees, though other roofs may be suitable too. You should also. Rooftop solar – the most common option for residential solar – offers you a way to harness the power of the sun through panels installed on the roof of your. A rooftop solar power system, or rooftop PV system, is a photovoltaic (PV) system that has its electricity-generating solar panels mounted on the rooftop of. Solar panel efficiency explained: most efficient solar panels · 1. SunPower Maxeon Residential AC W · 2. REC Group Alpha Pure-RX W · 3. Jinko Solar. In our opinion, Trina Solar is right up there with Q Cells when it comes to high-quality equipment for the money. Trina panels are a bit more expensive at an. Glass solar tiles produce energy, while architectural-grade steel tiles add longevity and corrosion resistance to your roof. Both are durable, strong and. Monocrystalline solar panels are the most common and efficient type of solar panel available. Due to the silicon's high purity, these panels excel at producing. The size, shape, and slope of your roof are also important factors to consider. Typically, solar panels perform best on south-facing roofs with a slope. Sparks solar is one of the leading solar companies in India. They produce the best solar panels for home in India market at very low cost. Spark has the best. Typically, solar panels perform best on south-facing roofs with a slope between 15 and 40 degrees, though other roofs may be suitable too. You should also. Rooftop solar – the most common option for residential solar – offers you a way to harness the power of the sun through panels installed on the roof of your. A rooftop solar power system, or rooftop PV system, is a photovoltaic (PV) system that has its electricity-generating solar panels mounted on the rooftop of. Solar panel efficiency explained: most efficient solar panels · 1. SunPower Maxeon Residential AC W · 2. REC Group Alpha Pure-RX W · 3. Jinko Solar. In our opinion, Trina Solar is right up there with Q Cells when it comes to high-quality equipment for the money. Trina panels are a bit more expensive at an. Glass solar tiles produce energy, while architectural-grade steel tiles add longevity and corrosion resistance to your roof. Both are durable, strong and. Monocrystalline solar panels are the most common and efficient type of solar panel available. Due to the silicon's high purity, these panels excel at producing.

There are two main types of solar panels: monocrystalline and polycrystalline. Which one you choose will impact the overall look of your system, its cost, how. Ground-mounted solar systems have one large advantage over a rooftop system: They offer the best control over your array's direction and angle. The bluer solar panels, while less professional-looking overall, are easier to match to your roof; blue looks okay on any background. Discover the ins and outs of solar energy installation with this helpful guide. Learn top tips for selecting solar panels, choosing a contractor. Solar X is the best solar panel contractor in Canada. Based in Toronto, we install solar panels from Halifax to Vancouver. The best van solar panels have five essential components: 1. Sunpower cells - even if a cell is partially shaded they still produce power. Sunpower's A+ grade. Rooftop Solar is NABCEP (solar) Certified, licensed, bonded and insured. At Rooftop, solar isn't just a job, it's a passion. Your system will be installed by. Qcells: Best overall solar panel Qcells was voted the best overall solar panel brand with an Elite rating from SolarReviews'. Qcells is one of the most. Tax incentives and flexible financing options ensure you get the best price for your solar system. Wide side view of solar panels on roof. Simple Aesthetic. Typically, solar panels perform best on south-facing roofs with a slope between 15 and 40 degrees, though other roofs may be suitable too. You should also. Top 10 solar panels, compared · 1. SunPower, M series SPR-MH-AC, % · 2. REC Group, Alpha Pure-R W % · 3. Panasonic, EverVolt HK EVPV Black SolarUp's residential rooftop solar panel systems are a smart financial decision and a reliable way to reduce your emissions, while saving your family from. Monocrystalline solar panels are the most common and efficient type of solar panel available. Due to the silicon's high purity, these panels excel at producing. Metal roofing sheets are a more well-known choice for solar panel installations material. With a life expectancy of 40 to 75+ years, metal rooftops are known. Metal roofing sheets are a more well-known choice for solar panel installations material. With a life expectancy of 40 to 75+ years, metal rooftops are known. SunPower is known for high efficiency solar panels, top performance and highest quality materials Your roof isn't a very hospitable place, so. An east or west facing roof will also work well, but a north facing roof is not recommended. Trying to find the best solar panel installers in your area can. Solar panels are best suited to homes with certain kinds of roofs and in The age, size, and slope of your roof, the amount of shade due to trees. roof can accommodate larger panels. At GoGreenSolar, we'll work with you to create a solar system that includes the best solar panels for your budget and. Trinity Solar is our first choice for solar installations. It provides top-notch customer support networks with high-quality solar panel installations.

Accion Loans Review

:max_bytes(150000):strip_icc()/Accion-Recirc-3b5af3134fd14746b81eb6da93a18836.jpg)

We'll review and come back with a final offer and loan ¹ Loans made by Accion Opportunity Fund Community Development. California Finance Lenders license. Community Economic Development and Finance · Community Economic Development and Finance. User Reviews. There are no reviews for this agency yet. Rate this. Low interest rates. Accion Opportunity Fund keeps rates on par with traditional lenders, despite lending to higher-risk businesses. Its rates start at Accion is a global nonprofit organization that started in Venezuela. It now offers loans for businesses across the US. Relaxed loan qualifications make them. Additionally, 8 states that Accion's flexible loan requirements allow business owners to get the working capital they need. This implies that the loans provided. Reviews from Accion employees about Accion culture, salaries, benefits Processing Loans and getting awarded bonuses for a job well done. Was this. This organization is not BBB accredited. Business Loans in San Jose, CA. See BBB rating, reviews, complaints, & more. Accion is a nonprofit company that offers small business loans for a variety of different purposes. It is a good option for startup and small businesses with. Qualifying for Accion financing But Accion has otherwise flexible borrower requirements. The exact numbers will depend on your business's location, but Accion. We'll review and come back with a final offer and loan ¹ Loans made by Accion Opportunity Fund Community Development. California Finance Lenders license. Community Economic Development and Finance · Community Economic Development and Finance. User Reviews. There are no reviews for this agency yet. Rate this. Low interest rates. Accion Opportunity Fund keeps rates on par with traditional lenders, despite lending to higher-risk businesses. Its rates start at Accion is a global nonprofit organization that started in Venezuela. It now offers loans for businesses across the US. Relaxed loan qualifications make them. Additionally, 8 states that Accion's flexible loan requirements allow business owners to get the working capital they need. This implies that the loans provided. Reviews from Accion employees about Accion culture, salaries, benefits Processing Loans and getting awarded bonuses for a job well done. Was this. This organization is not BBB accredited. Business Loans in San Jose, CA. See BBB rating, reviews, complaints, & more. Accion is a nonprofit company that offers small business loans for a variety of different purposes. It is a good option for startup and small businesses with. Qualifying for Accion financing But Accion has otherwise flexible borrower requirements. The exact numbers will depend on your business's location, but Accion.

We'll review and come back with a final offer and loan agreement. Upon signing, you'll get the money you need for your business. What you get. Accion. $, ACCION OPPORTUNITY FUND BUSINESS LOANS REVIEW | GET ACCION BUSINESS LOAN WITH BAD CREDIT. reichbaum.ru 3 1 Comment · Like. ACCION helps with loans and it is trustworthy fast and reliable. Friendly Direct review | Jun 10, Overall Thought. Excellent. ACCION helps with. Profit sharing at end of every financial year. Cons. Week loan recovery processes. Was this review helpful? Accion Reviews Accion is a global nonprofit with a mission to advance financial inclusion by giving people the financial tools to improve their lives. We are Ascendus (formerly Accion East) and we've been waiting for you. Let's financial journey. apply for a loan · find funding. we believe in the. a loan officer from Sub-K assists a client. Case Study. Insights to action: The strategic importance of a holistic data review. Accion Advisory. 07 Mar It is amazing what those they help can do with such small loans! I also like that Accion does not overwhelm me with appeals - several times a year they mail. All Business Lender Reviews · Accion Business Loans Review · Biz2Credit Small-Business Loans Review · Bluevine Business Loans Review · CIT Bank Business Loans. loan application, loan origination software, an automated preliminary review, access to Accion Texas underwriting, and automated closing documents. With MMS. Does Accion Small Business Loans report your account activity to credit bureaus? Yes, Accion Small Business Loans reports your account activity to one or more. Accion Opportunity Fund provides financial support and loans for small businesses that advance racial, gender, and economic justice for all. Learn more. Award-winning, nonprofit org increasing access to credit, loans. DreamSpring provides community support to help entrepreneurs realize their dreams. 4 reviews of ACCION USA "Accion USA is a micro lending organization that can help people inspired to start or maintain their business. • ACCION Loan Officer OK Loans – Loan officer approves loans up to. $ for • We perform automated review of application. • Give client feedback on. Accion Opportunity Fund's lending arm, Accion Opportunity Fund Community Development (AOFCD). All loans are subject to underwriting review and approval. A Full Skip Review: Business Grants, Funding, and More · 1. Business Grant Opportunities · 2. Business Loans & Financing · 3. Deadline-Based Sorting · 4. Multiple-. I had made many calls before finally stumbling upon Accion. Accion helped me secure financing for equipment in my first small start up, with almost 20%%. Accion offers options for small loans, which is a plus for many businesses that are getting started. Term loan rates start at just % and vary by credit. LiftFund helps startups and entrepreneurs like you with funding, tools and resources. Get small business loans, SBA loans and microloans in Texas and.

Monthly Financial Calendar

It does, is summarizes accounting periods and material dates throughout the fiscal year by fiscal week, within your financial value stream. The Operating ledger runs on the Universities Fiscal Year - from May 1st to April 30th. The Fiscal Year is represented by the last two digits of the calendar. This practical printable calendar helps you manage your finances in a convenient format that you can attach to your budget planner. Calendars · Social Graphics · Photo Pick a few to spruce up the look of your monthly finance planner template and help you organize your financial details. Financial Wellbeing Calendar: Edition. 00_Cover_Mock up 2. When does College Savings Month take place? How about Financial Planning Week? When is the. Contents · 1 52–week fiscal year. Last Saturday of the final month; Saturday nearest the end of the final month · 2 See also · 3 References. The Finance Calendar lays the foundation for successful business partnerships by setting shared expectations and a vision for success. Financial Wellbeing Calendar: Edition. 00_Cover_Mock up 2. When does College Savings Month take place? How about Financial Planning Week? When is the. Monthly Closing Calendar ; May (Period 11), Friday, May 31, ; June (Interim), Friday, June 28, ; June (Period 12), Monday, July 15, It does, is summarizes accounting periods and material dates throughout the fiscal year by fiscal week, within your financial value stream. The Operating ledger runs on the Universities Fiscal Year - from May 1st to April 30th. The Fiscal Year is represented by the last two digits of the calendar. This practical printable calendar helps you manage your finances in a convenient format that you can attach to your budget planner. Calendars · Social Graphics · Photo Pick a few to spruce up the look of your monthly finance planner template and help you organize your financial details. Financial Wellbeing Calendar: Edition. 00_Cover_Mock up 2. When does College Savings Month take place? How about Financial Planning Week? When is the. Contents · 1 52–week fiscal year. Last Saturday of the final month; Saturday nearest the end of the final month · 2 See also · 3 References. The Finance Calendar lays the foundation for successful business partnerships by setting shared expectations and a vision for success. Financial Wellbeing Calendar: Edition. 00_Cover_Mock up 2. When does College Savings Month take place? How about Financial Planning Week? When is the. Monthly Closing Calendar ; May (Period 11), Friday, May 31, ; June (Interim), Friday, June 28, ; June (Period 12), Monday, July 15,

Budget Calendar - Monelyze 4+. Expense Tracker & Daily Budget. Monelyze I do wish you could set the timeline to be longer than a month at a time to. Find earnings, economic, stock splits and IPO calendars to track upcoming financial events from Yahoo Finance. Monthly-Paid Staff (Exempt). Monthly Employee Pay Dates · Monthly Payroll Schedule for Payroll Representatives. Non-compensatory Payments. Non-compensatory. University of Texas at Austin Accounting and Financial Management, Main 4 Inner Campus Drive, Stop K Austin, TX Check out our financial calendar selection for the very best in unique or custom, handmade pieces from our calendars & planners. Financial Management. > Accounting / Controller's Office. > Accounting Manual. > Month-End Calendar. Month-End Calendar. Month End Calendar. Helpful Links. Our month-by-month guide to help get your finances in top shape this year. Submitting documents in a timely manner is key to ensuring that the financial process continues in an uninterrupted fashion. Month End Cut-off Schedule. Monthly Closing Calendar · If the last day of the month falls on a Saturday or a Sunday, the month-end closing date will always be on the preceding Friday. This product includes 12 printables, one calendar labeled for each month of the year. Please note that this product is sold as a digital download. Budget Planner & Monthly Bill Organizer with 12 Envelopes and Pockets. Expense Tracker Notebook and Financial Planner Budget Book to Control Your Money. The Monthly Budget Calendar is a minimalist spending tracker and monthly budget for Google Sheets. Everything is streamlined in a simple monthly calendar view. Economic calendar: get indicators in real-time as economic events are announced and see the immediate global market impact - Including previous. Monthly Calendar The monthly calendar aligns with your accounting close process and maps out inter-month activities such as operating reviews and financial plan. The Investopedia Personal Finance Calendar lists monthly market-moving events, tax deadlines, holidays, and other important dates. Management Reports. Report Month; Report Date; Scheduled Closing Date · Transaction Due Date. Departmental Deposits; Journal Entries; Interface Billings & PCard. The month-end close calendar is an 8 business day process closing the Workday financial accounting books each month. This Week's Major U.S. Economic Reports & Fed Speakers. Time (ET), Report, Period, Actual, Median Forecast, Previous. MONDAY. A fiscal quarter is a three-month period on a company's financial calendar that acts as a basis for the reporting of earnings and the paying of dividends.

Who To Buy Stocks From Right Now

A daily updated list of the top stocks to buy now. The experts at Benzinga keep smart investors informed for better decision making. Top traded stocks right now as per the TD Direct Investing Index ; 1 · SHOP SHOPIFY INC CL-A SVS · No change from #1 ; 2 · BNS BANK OF NOVA SCOTIA · Up from #5 ; 3. Stocks ; NVDA NVIDIA Corporation. (%) ; TSLA Tesla, Inc. (%) ; NIO NIO Inc. + (+%). Already have a brokerage account? You can start investing now. Simplify your portfolio management by transferring your investments from other companies to. Please note: the Preferred Shares are for investment only by investors who You can sign up now to get information about our planned Public Offering. Good financials: Reviewing the financial profile of the companies whose stocks you're considering buying will give you a sense of the firm's assets and. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Stocks to Buy ; 3 Stocks for the AI Age · Thomas Yeung, CFA, InvestorPlace Markets Analyst ; Why 90% of Companies Are Investing Millions in This · Luke Lango. Find investment ideas for your portfolio with the latest stock picks from Barron's. This Why D.R. Horton Is the Home Builder Stock to Buy Now. View More. A daily updated list of the top stocks to buy now. The experts at Benzinga keep smart investors informed for better decision making. Top traded stocks right now as per the TD Direct Investing Index ; 1 · SHOP SHOPIFY INC CL-A SVS · No change from #1 ; 2 · BNS BANK OF NOVA SCOTIA · Up from #5 ; 3. Stocks ; NVDA NVIDIA Corporation. (%) ; TSLA Tesla, Inc. (%) ; NIO NIO Inc. + (+%). Already have a brokerage account? You can start investing now. Simplify your portfolio management by transferring your investments from other companies to. Please note: the Preferred Shares are for investment only by investors who You can sign up now to get information about our planned Public Offering. Good financials: Reviewing the financial profile of the companies whose stocks you're considering buying will give you a sense of the firm's assets and. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Stocks to Buy ; 3 Stocks for the AI Age · Thomas Yeung, CFA, InvestorPlace Markets Analyst ; Why 90% of Companies Are Investing Millions in This · Luke Lango. Find investment ideas for your portfolio with the latest stock picks from Barron's. This Why D.R. Horton Is the Home Builder Stock to Buy Now. View More.

I believe it is worth it to sell VGT to purchase VOO. But now, how can I optimally reduce capital gains tax in selling and purchasing a different ETF? I have. Losers will be cut and replaced by winners. Already a member of Zacks Top Ten Stocks? Sign in now. Otherwise click below for more details. ▸ Take Advantage Now. Top Penny Stock Losers ; BIG. Big Lots ; WHLR. Wheeler Real Estate Investment ; HYZN. Hyzon Motors ; OVID. Ovid Therapeutics. Trading commissions: These are fees brokers charge when you buy or sell securities. Many brokers now offer commission-free trades for particular investments. confidently states that $1k invested in 5 largest food stocks, buy after ex div, sell before earnings yields 29% annually. A cool idea that prompted me to get. Investments fall as well as rise in value, so you could get back less than you put in. If you're not sure whether an investment is right for you, please speak. Yes it is. The market will always be up or down, every single day. It is true that you should attempt to buy stocks when they are on sale (down). Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Buy PI Industries, target price Rs Motilal Oswal · Buy Atul, target price Rs Motilal Oswal · Buy Kirloskar Ferrous Industries, target price Rs JM. Stocks to Buy Today · 1. SUVENPHAR: CONTINUATION OF UPTREND · 2. AAVAS: RISING VOLUME · 3. JINDALSTEL: PULLBACK FROM SUPPORT · 4. BHEL FUT: BEARISH MOMENTUM · 5. Top Performers · #1. Skillsoft Corp. - Ordinary Shares - Class A (SKIL) · #2. Barnes & Noble Education Inc (BNED) · #3. Bakkt Holdings Inc - Ordinary Shares -. Stock Screener Stock Ideas Strong Buys According to Wall Street. Strong Buys According to Wall Street. Companies with high upside and a consensus strong buy. Best stock for beginners · Broadcom (AVGO). · JPMorgan Chase (JPM). · UnitedHealth (UNH). · Comcast (CMCSA). · Bristol-Myers Squibb Co. (BMY). Our top picks for where to buy reddit stocks ; Top pick for advanced traders. Tastytrade logo · Get up to $5, cash. Trade options, futures, options on futures. I believe it is worth it to sell VGT to purchase VOO. But now, how can I optimally reduce capital gains tax in selling and purchasing a different ETF? I have. Best Stocks to Day Trade · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · Tesla Inc. (TSLA) · Marathon Digital Holdings (MARA) · GameStop Corp. (GME). Companies are sorted by daily volume and supplied with other stats to help you find out why they are so popular right now. Get it on Google Play. The stock information provided is for informational purposes only and is not intended for trading purposes. The stock information and charts are provided by. Losers will be cut and replaced by winners. Already a member of Zacks Top Ten Stocks? Sign in now. Otherwise click below for more details. ▸ Take Advantage Now. Investors buy stocks for various reasons. Here are some of them: Capital Planning for the future starts right now! Free Financial Planning Tools.

1 2 3 4 5