reichbaum.ru Tools

Tools

Covered Call Writer

Want to maximize your profits and minimize risk with covered call writing? In this blog post, we'll share expert tips and strategies for successful covered. Option Strategies ; Short Call + Long Stock (Also referred to as Covered Call Writing) · Buy stock and sell at-the-money call · When stock price is above break-. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. In the Money - A covered call is in the money when the strike price is below the current share price - example: a call option at the $30 strike price would be. Covered call writers can protect against downside price movement by selling in the money calls. This is commonly done after a rise in a security that is already. The most basic variant of covered call writing is simply writing calls and letting the trades go to expiration, then selling the stock if not called; or writing. strategy, is implemented by writing (selling) a call option contract while owning an equivalent number of shares of the underlying. A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. Want to maximize your profits and minimize risk with covered call writing? In this blog post, we'll share expert tips and strategies for successful covered. Option Strategies ; Short Call + Long Stock (Also referred to as Covered Call Writing) · Buy stock and sell at-the-money call · When stock price is above break-. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. In the Money - A covered call is in the money when the strike price is below the current share price - example: a call option at the $30 strike price would be. Covered call writers can protect against downside price movement by selling in the money calls. This is commonly done after a rise in a security that is already. The most basic variant of covered call writing is simply writing calls and letting the trades go to expiration, then selling the stock if not called; or writing. strategy, is implemented by writing (selling) a call option contract while owning an equivalent number of shares of the underlying. A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis.

A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. A covered call is issued by a call writer who owns the underlying asset; otherwise, the call writer would be creating a naked call. If the call is exercised. When we manage for "Total Return", we will partially write against our underlying holdings, selling O-T-M (out-of-the-money) covered calls against a range of Because covered call writing involves both stock and short call positions, covered calls can be more complicated than stocks alone. However, if. It typically consists of writing one call option contract for every shares held in a portfolio and repeating the operation from one expiration date to the. Writers of uncovered (or “naked”) calls, unlike writers of covered calls, do not own the underlying stock. In this aggressive investment approach, the potential. It typically consists of writing one call option contract for every shares held in a portfolio and repeating the operation from one expiration date to the. A covered call strategy involves holding a long position in a stock and then selling (or writing) a call option on the asset to generate income. Wow! This is a true Encyclopedia of Covered Calls. Alan has put so much in this book. It has a system that anyone can follow. He sets you up at the start with a. Covered call option writing, also known as a “buy-write” strategy, can offer a steady stream of incremental income in the form of option premiums while reducing. In this case, your calls will be assigned, you will be forced to sell your shares at $50, and you will keep the $1 premium, effectively selling your shares at. Alan Ellman's Encyclopedia for Covered Call Writing covers option trading basics, stock fundamental and technical analysis, exit strategies. Covered call writing is an options trading strategy used to generate income from stocks owned by the trader. With this strategy, the trader sells or. Covered call writing is an options trading strategy used to generate income from stocks owned by the trader. With this strategy, the trader sells or. A covered option is a financial transaction in which the holder of securities sells (or "writes") a type of financial options contract known as a "call" or. A Comprehensive Approach to Covered Call Writing · Managing the Strategy · Tax Issues · Which Stocks to Select · Which Options to Select · Dividend Capture. Calculate the rate of return in your cash or margin buy write positions. This calculator will automatically calculate the date of expiration. A covered call option is another basic option strategy that aims to provide small but consistent income while owning a stock. A covered call is issued by a call writer who owns the underlying asset; otherwise, the call writer would be creating a naked call. If the call is exercised. See what exit strategies can do for you! Learn the best and most effective stock option strategies to manage your positions.

How Do I Build Credit Without A Credit Card

You may be able to build credit without a regular credit card by applying for a secured credit card. Unlike unsecured credit cards, secured cards require a. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. Become an authorized user: Without having to apply for a credit card of your own, you can request to become an authorized user on another person's card. This. 1. Become an Authorized User · 2. Get a Secured Credit Card · 3. Report Your Rent and Utility Payments to Credit Bureaus · 4. Apply for a Retail Card · 5. Take Out. A lack of credit history shouldn't stop you from getting a credit card. It simply means you don't have any active credit accounts being reported to the three. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. 6 ways to build credit without using a credit card · 1. Credit-builder loan. A credit-builder loan essentially allows you to lend yourself money, Kelly explains. In this guide, we will discuss how to build credit without a credit card. The key here is to demonstrate that you're consistently able to pay back what you owe. Have someone else who has good credit, add you as an authorized use to their credit card. Basically, their positive credit history will appear. You may be able to build credit without a regular credit card by applying for a secured credit card. Unlike unsecured credit cards, secured cards require a. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. Become an authorized user: Without having to apply for a credit card of your own, you can request to become an authorized user on another person's card. This. 1. Become an Authorized User · 2. Get a Secured Credit Card · 3. Report Your Rent and Utility Payments to Credit Bureaus · 4. Apply for a Retail Card · 5. Take Out. A lack of credit history shouldn't stop you from getting a credit card. It simply means you don't have any active credit accounts being reported to the three. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. 6 ways to build credit without using a credit card · 1. Credit-builder loan. A credit-builder loan essentially allows you to lend yourself money, Kelly explains. In this guide, we will discuss how to build credit without a credit card. The key here is to demonstrate that you're consistently able to pay back what you owe. Have someone else who has good credit, add you as an authorized use to their credit card. Basically, their positive credit history will appear.

It's hard to build credit without a credit card or loans but not impossible. Learn the best ways to build credit with Securityplus Federal Credit Union. We've compiled a list of 11 ways to help you learn how to build credit without a credit card, including using the best budgeting apps and regularly checking. Any loans you may have, whether they are auto, mortgage, or student loans, must be paid on time in order to establish a good credit history. If you already have. Yes. You can build a credit score without a credit card. The credit bureaus receive payments and credit histories from other companies that don't offer credit. Start building credit with your daily purchases. Extra gives you a line of credit called 'Spend Power' to turn your daily purchases into credit worthy payments. Pay off existing loans. Whether it's an auto loan, credit card bill, mortgage, or any other tradeline, paying your current creditors is a great way to build. You can improve your credit by adding accounts and building a great payment history by making on-time payments towards multiple credit accounts. Usually, payments toward things like Netflix, Spotify, Hulu, or Disney + don't count towards your credit score. But with the Altro app, anything that you pay. Brigit's Credit Builder allows you to build credit without a credit card. You'll make payments each month, as little as $1, and they'll report your payments to. A quick and easy way to improve your credit score is to register on the electoral roll. You can do this by registering to vote on the reichbaum.ru website. With a small deposit, usually $ or less, you can get a secured credit card. These are credit cards for people with no credit history. The deposit secures. Here are five things you can do right now that can help you build your credit rating and serve as the foundation for your financial future. Consumers who can't—or don't want to—obtain a credit card can build a credit history in other ways. 6 Easy Ways to Build Credit Without Credit Cards · 1. Put services in your name. Most utility providers (cable, electricity, internet, etc.) · 2. Apply for a. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. One of the quickest and easiest ways to boost your credit is taking out a personal loan. Personal loans have several advantages. First, it gets you access to. If you do not want to open a credit card, you do have other options that can be used to build and improve your credit score. Things like student loans, auto. Using a credit card is a common way for people to build credit. You can charge everyday expenses to the card, pay the balance each month, and watch your score. You can use your credit card to make purchases, and they are very convenient. One way to start a credit history is to have one or two department store or gas.

Can You File For Divorce Online In Georgia

Do it yourself GA divorce forms and Georgia divorce papers with detailed instructions on how to file a no-fault divorce in Georgia without a lawyer. But divorce decrees and divorce case files can not be requested online through the portal. How Do I seal My Divorce Records in Georgia? Georgia's divorce. We help prepare all of the necessary divorce forms and provide detailed written instructions on how to file your divorce in Georgia. Find links to forms to file for a divorce and answer a divorce complaint in Georgia We have created the following guides to help you navigate these common. You must file for divorce with the Clerk of the Superior Court in the county where you or your spouse have lived for at least 6 months. You can also look at your county's website (or the county site when you must file your divorce) to check for Superior Court Divorce forms or packets. Unfortunately the state of Georgia doesn't offer the documents necessary to file a divorce online. You must obtain these documents from your local County Clerk. You can actually file yourself, if both parties are amenable. Two hundred something filing fee, fill out all the summons and answer. Some counties in Georgia require you to file your divorce paperwork online (even when you're representing yourself), so check with the clerk's office to find. Do it yourself GA divorce forms and Georgia divorce papers with detailed instructions on how to file a no-fault divorce in Georgia without a lawyer. But divorce decrees and divorce case files can not be requested online through the portal. How Do I seal My Divorce Records in Georgia? Georgia's divorce. We help prepare all of the necessary divorce forms and provide detailed written instructions on how to file your divorce in Georgia. Find links to forms to file for a divorce and answer a divorce complaint in Georgia We have created the following guides to help you navigate these common. You must file for divorce with the Clerk of the Superior Court in the county where you or your spouse have lived for at least 6 months. You can also look at your county's website (or the county site when you must file your divorce) to check for Superior Court Divorce forms or packets. Unfortunately the state of Georgia doesn't offer the documents necessary to file a divorce online. You must obtain these documents from your local County Clerk. You can actually file yourself, if both parties are amenable. Two hundred something filing fee, fill out all the summons and answer. Some counties in Georgia require you to file your divorce paperwork online (even when you're representing yourself), so check with the clerk's office to find.

Divorces can be contested, uncontested or by publication; the type of divorce you file determines the legal documents you must file with the Clerk's office. Some counties in Georgia require you to file your divorce online (even when you're representing yourself), so check with the clerk's office to find out about. In Georgia, if you want to end your marriage, you must file a complaint for divorce in the. Superior Court. You can either hire an attorney who will prepare. How long do you have to live in Georgia to file for divorce? You must have lived in Georgia for at least six months prior to filing a divorce action. Do you. Online Divorce in Georgia. Divorce papers ready to download in 2 business days; Step-by-step filing instructions with 24/7 customer support; Affordable and. Unfortunately the state of Georgia doesn't offer the documents necessary to file a divorce online. You must obtain these documents from your local County Clerk. Can I file for an online divorce in Georgia if my spouse lives in another state? You can file for an online divorce in Georgia if your spouse lives in. With 3StepDivorce TM, you can complete and print your Georgia divorce forms (including a marital settlement agreement) instantly. Follow our step-by-step. With DivorceWriter you create the documents needed to complete a divorce yourself without a lawyer. The online interview covers property division, child custody. Online divorce service DivorceOnline is designed to eliminate the paperwork hassle assisting divorcing spouses get the completed divorce forms. Check your. Online Divorce in Georgia | Cheap & Quick Filing for Divorce (GA) | Get Your Completed Divorce Forms | ☎ II, Par. 1.) Some counties in Georgia require you to file your divorce paperwork online (even when you're representing yourself), so check with the court clerk. Learn how to file for a quick online divorce with Family Law Attorney Mediator. 25 years' experience. Easy, low cost papers filed in GA. If you are looking for a reliable online divorce service in Georgia, look no further than ReliableDivorce. We have been helping people get divorced since Before you file for divorce on your own, you need to talk to your spouse, if possible, and find out how he/she feels about the divorce and about the issues. Georgia Judicial Services Portal. Divorce, like other court procedures, is driven by legal forms. If you are planning to file for divorce in Georgia, you need to know the forms used in. Learn how to get divorced in Georgia. Find a qualified attorney, determine the type of divorce, file your petition, and navigate the process effectively. With Georgia Divorce Online you can start your divorce process online and from the comfort of your own home or office. Delivering our services completely online. Resources and Forms · Find divorce forms and instructions on the Georgia Courts website (the links are to fillable PDFs that may not be fully accessible). · Use.

Forex Broker Fees Comparison

Description. For traditional traders, costs to trade is bid/ask spread. Major FX pairs as low as with low commissions ; FX spreads. Variable spreads, EUR/USD. Spreads are effectively the difference between the bid/ask price on any particular asset, and this is where most brokers make their profit, especially if they. In our comparison, Fusion Market's commissions were $ per lot traded, which is lower than the industry average, saving you 35%. Which Forex Broker Has The Best Leverage & Margin Rates? All retail forex brokers regulated by the FCA offer the same margin of %. Being able to trade forex. Compare Online Brokerage platform in terms of fees and charges and learn how to go about Forex trading in Singapore broker. Leverage is often used by. Use our Brokers Comparison Tool to compare forex brokers with different dimensions like regulations, deposit & withdrawal, trading environment, etc. Compare top Forex brokers with ease. Get in-depth side-by-side analyses of trading platforms, fees, and more to find your perfect trading partner. Interest charges on the balance ; Free education ; Expert advisors ; Partnership programs. Introduction to Forex Broker Commissions · Fixed Commission: In this structure, the broker charges a fixed fee for each trade, regardless of the. Description. For traditional traders, costs to trade is bid/ask spread. Major FX pairs as low as with low commissions ; FX spreads. Variable spreads, EUR/USD. Spreads are effectively the difference between the bid/ask price on any particular asset, and this is where most brokers make their profit, especially if they. In our comparison, Fusion Market's commissions were $ per lot traded, which is lower than the industry average, saving you 35%. Which Forex Broker Has The Best Leverage & Margin Rates? All retail forex brokers regulated by the FCA offer the same margin of %. Being able to trade forex. Compare Online Brokerage platform in terms of fees and charges and learn how to go about Forex trading in Singapore broker. Leverage is often used by. Use our Brokers Comparison Tool to compare forex brokers with different dimensions like regulations, deposit & withdrawal, trading environment, etc. Compare top Forex brokers with ease. Get in-depth side-by-side analyses of trading platforms, fees, and more to find your perfect trading partner. Interest charges on the balance ; Free education ; Expert advisors ; Partnership programs. Introduction to Forex Broker Commissions · Fixed Commission: In this structure, the broker charges a fixed fee for each trade, regardless of the.

Forex Broker Quotes Comparison ; BDSwiss. , ; AMEGA. , ; AAAFx. , ; CMC Markets. , How to Compare Rates Between FX Brokers. When you are comparing currency exchange rates and transaction fee rates, keep in mind that there is no one standard. Compare spreads, commissions, and other fees charged by brokers for trading. Lower trading costs can significantly impact your profitability, so. forex traders. Comparison of Features and Fees of The Top Commission-Free Trading Platforms. Platform. Features. Fees. Robinhood. Commission-free trading, easy. Brokers in the forex market charge different types of fees, known as commissions. These fees can vary from one broker to another, so it's essential for traders. It's important to compare different brokers to find out which one offers the best combination of low spreads and no swap fees. Keeping positions open overnight. Compare forex and CFD brokers, MetaTrader 4 demo accounts and trading platforms, no dealing desk and ECN, bonuses, commissions and spreads, leverage. IG Markets: They offer favorable trading conditions with 0 fees and an average EUR/USD spread of It's a solid choice if you're looking. Standard account users can trade currency pairs with spreads starting at pips, with no commission contributing to the fairly low fee paid per trade. With account types from $0 commissions per lot and raw spreads, the company positions itself as a low-cost broker for any trader wishing to access the global. Forex Broker Comparison - a side by side comparison tool to compare spreads, regulation and other features and help you select the best broker for your. Brief Educational Program on Comparing Forex Brokers. Detailed Guide how compare forex brokers Fees and Forex Broker Spread Comparison. In Forex Trading the. Investors should seek out a broker that offers reasonable fees, a user Forex (or FX) trading entails trading currencies, contract for differences. Forex trading is highly regulated in the United States. In this guide, we review the best U.S.-complaint Forex brokers, comparing their fees, leverage, pros. Our forex broker comparison tool lists the minimum spread on the EUR/USD currency pair. This is because this is the most popular currency pair with forex. In addition to the spread, some Forex brokers charge a commission on each trade. This commission is usually a fixed amount per lot traded or a percentage of the. Costs are very important to every trader and as a result, spreads must be as small as possible in order for a forex broker to be considered a good choice. CFDs On Stocks, Indices, Metals, and Forex. Leverage products; Forex; Cryptocurrencies Only in the US. Commodities; Fees; US stocksTiered plan: Up to $ Compare a range of forex brokers, find the right broker for you. Assess broker services, fees, and reviews. Compare forex brokers and find the right broker for your own trading and investment needs. Compare features, fees, reviews, ratings, and bonus offers.

Can I Switch To Metropcs From T Mobile

T Mobile Devices (Regardless if they're locked or unlocked) will work with MetroPCS as it's the same network. I have a T Mobile Prepaid Store so. MetroPCS is now Metro by T-Mobile. Today, there are more wireless carriers than ever from which to choose if you need cell phone service or wish to switch from. Can I switch to Metro by T-Mobile online but keep my phone number? Yes, it's possible to keep the number you already have from your current service provider. Go to reichbaum.ru > Login into your account > Profile Settings > Request a Transfer PIN; or; Call Request Number Transfer PIN > Follow the verification. Your new Verizon line can make calls but can't receive them and texting may not work. Once your number transfer is done, all your mobile service will be. Metro by T-Mobile (formerly known as MetroPCS and also simply known as Metro) is an American prepaid mobile virtual network operator (MVNO) wireless service. Limitations · Current T-Mobile and Metro by T-Mobile customers or customers of T-Mobile partners using the T-Mobile network are not eligible · If bringing your. Need help transferring your number? Just stop by your closest T-Mobile store or call T-MOBILE. Find a store. Got questions? Can I switch to T-Mobile. Get your choice of a FREE 5G phone when you switch and trade in any eligible device - all backed by the power of T-Mobile's network at no extra cost. T Mobile Devices (Regardless if they're locked or unlocked) will work with MetroPCS as it's the same network. I have a T Mobile Prepaid Store so. MetroPCS is now Metro by T-Mobile. Today, there are more wireless carriers than ever from which to choose if you need cell phone service or wish to switch from. Can I switch to Metro by T-Mobile online but keep my phone number? Yes, it's possible to keep the number you already have from your current service provider. Go to reichbaum.ru > Login into your account > Profile Settings > Request a Transfer PIN; or; Call Request Number Transfer PIN > Follow the verification. Your new Verizon line can make calls but can't receive them and texting may not work. Once your number transfer is done, all your mobile service will be. Metro by T-Mobile (formerly known as MetroPCS and also simply known as Metro) is an American prepaid mobile virtual network operator (MVNO) wireless service. Limitations · Current T-Mobile and Metro by T-Mobile customers or customers of T-Mobile partners using the T-Mobile network are not eligible · If bringing your. Need help transferring your number? Just stop by your closest T-Mobile store or call T-MOBILE. Find a store. Got questions? Can I switch to T-Mobile. Get your choice of a FREE 5G phone when you switch and trade in any eligible device - all backed by the power of T-Mobile's network at no extra cost.

Contact us via phone or mail for Metro by T-Mobile customer support. Access tools to manage your account and make payments online. Comments96 · How To Swap Metro By T-Mobile Phone FREE! · Unlock your Metro by T-Mobile Phone % FREE · Metro By T-Mobile $15 Fee (EXPLAINED) · I. Metro by T-Mobile's posts ; Oct 6, · ; Sep 22, · Image. 40 ; Sep 22, · Embedded video. From reichbaum.ru 16 ; Sep 15, · Embedded. Once your data and settings have been transferred from one phone to the other, and the SIM cards have been switched out, then you'll go to the MetroPCS website. Make the switch to T-Mobile's nationwide 5G network. Join T-Mobile, bring your own phone, shop for a new phone, select a plan, and transfer your number. It's easy to transfer your current phone number when you switch to the nation's most reliable network. Enter your digit phone number to see if it can be. Yes, Metro by T-Mobile allows you to bring your own phone (BYOP), meaning you can buy a compatible phone (listed above) from a site like Swappa and use it with. I was wondering how MetroPCS can offer T-Mobile cell phone plan service switch and save” price reduction. Not a bad way to get a prepay smartphone. Shop prepaid cell phone plans from Metro by T-Mobile. Our best phone plans come with unlimited 5G data on T-Mobile's blazing-fast network! Rule your day with THE BIG 5G UPGRADE Ditch Boost or Cricket and head to a Metro store to SAVE HALF! Switch with a trade-in to get: $25/mo. Metro Customers who have made 12 consecutive payments and are in good standing can upgrade to T-Mobile for access to the best devices and plan perks - no. Looking to upgrade your cell phone? Our phone trade-in program gives you instant credit toward a new phone. Find out what your phone is worth today! How Do I Switch My Service to a New Phone? Metro customers that want to use their plan on different smartphones can do so with a simple SIM card swap, as long. Activate on eSIM · New customers can Activate from the Metro by T-Mobile website · Existing customers can switch to an eSIM compatible device by going to Switch. Shop for Metro by T-Mobile in Shop Phones by Carrier. Buy products such as Metro by T-Mobile TCL ION X, 32GB, Black - Prepaid Smartphone at Walmart and. I was wondering how MetroPCS can offer T-Mobile cell phone plan service switch and save” price reduction. Not a bad way to get a prepay smartphone. For Apple phones, simply contact T-Mobile and request that they unlock the device. For other carriers and brands, you should call your mobile provider for. One important thing to note: while you can purchase most Metro by T-Mobile phones online, you'll need to visit an actual store to set up your plan. Metro by T-. Thinking about switching to T-Mobile and wanting to keep your number? · There is no charge for transferring your phone numbers. · Wireless line: the transfer will. What do I need to Activate? · Phone and new SIM card: Have a compatible phone and new Metro by T-Mobile SIM card handy. · Choose a rate plan: You'll need to.

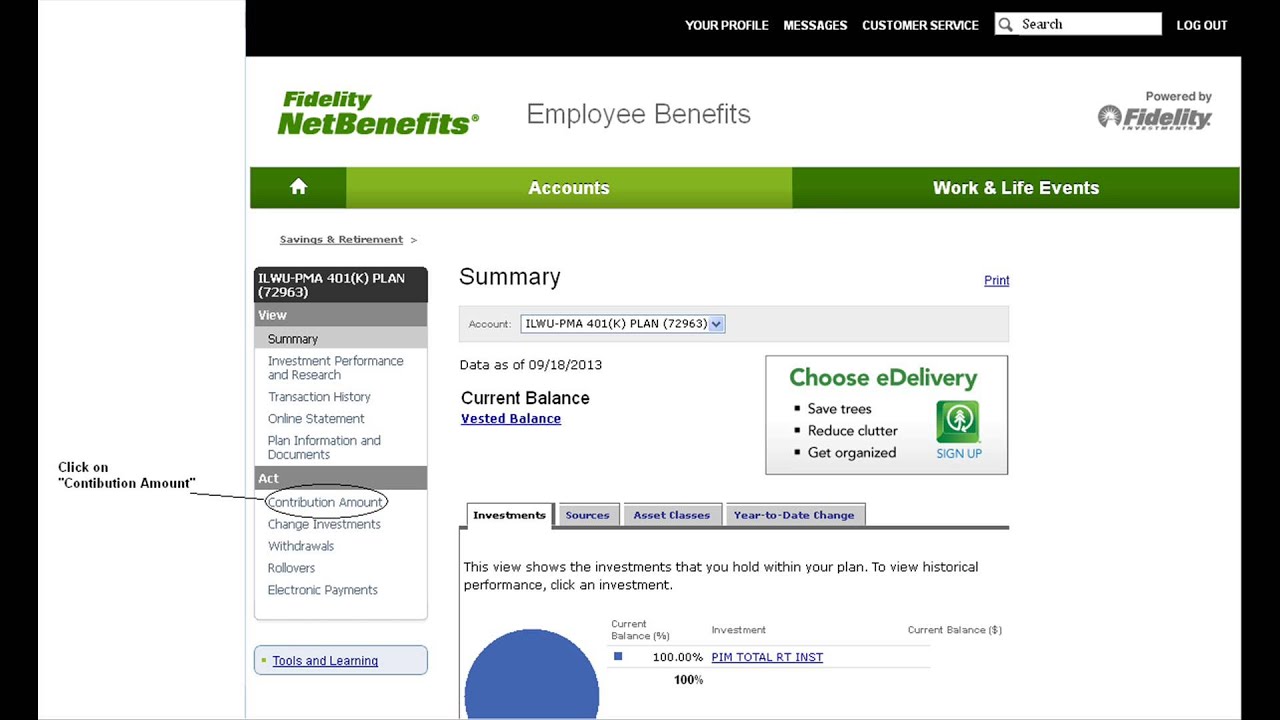

Closing Out 401k Fidelity

If you withdraw from your (k) before age 59½, the money will generally be subject to both ordinary income taxes and a potential 10% early withdrawal penalty. After you reach age 73, the IRS generally requires you to withdraw an RMD annually from your tax-advantaged retirement accounts (excluding Roth IRAs, and Roth. From the "Quick Links" tab, select "Loans or Withdrawals." · Choose the button "See your Options" to review your choices. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a If you leave your job for any reason and you want access to the (k) withdrawal rules for age 55, you need to leave your money in the employer's plan—at least. You may tap into (k) funds without penalty under certain circumstances. · Those who qualify for a hardship withdrawal can use the money for education. The next step in closing your (k) with Fidelity is to contact the financial institution directly. Reach out to Fidelity's customer service or account. No. You can withdraw money from your (k) plan as and when the plan document allows. There is no time when it has to allow you to withdraw —. Also, a 10% early withdrawal penalty generally applies on distributions before age 59½ for IRAs and (k)s, unless you meet one of the IRS exceptions. If you. If you withdraw from your (k) before age 59½, the money will generally be subject to both ordinary income taxes and a potential 10% early withdrawal penalty. After you reach age 73, the IRS generally requires you to withdraw an RMD annually from your tax-advantaged retirement accounts (excluding Roth IRAs, and Roth. From the "Quick Links" tab, select "Loans or Withdrawals." · Choose the button "See your Options" to review your choices. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a If you leave your job for any reason and you want access to the (k) withdrawal rules for age 55, you need to leave your money in the employer's plan—at least. You may tap into (k) funds without penalty under certain circumstances. · Those who qualify for a hardship withdrawal can use the money for education. The next step in closing your (k) with Fidelity is to contact the financial institution directly. Reach out to Fidelity's customer service or account. No. You can withdraw money from your (k) plan as and when the plan document allows. There is no time when it has to allow you to withdraw —. Also, a 10% early withdrawal penalty generally applies on distributions before age 59½ for IRAs and (k)s, unless you meet one of the IRS exceptions. If you.

Withdrawals can be initiated online for Traditional, Rollover, Roth and SEP IRAs using the "Withdraw from your IRA" button. For SIMPLE IRA distributions, please. Use this form to make a one-time withdrawal from your nonretirement Brokerage or Mutual Fund Only account. Do NOT use this form for retirement accounts. If your (k) plan or (b) plan has made loans that haven't complied with plan terms about loans, find out how you can correct this mistake. Return to. It is always possible to donate retirement assets, including IRAs, (k)s and (b)s,1 by cashing them out, paying the income tax attributable to the. For a withdrawal from your Employer-Sponsored Retirement Plan (such as a k or b) Single Withdrawal Request (You will be directed to NetBenefits. Once. The tax rate for your (k) distributions will depend on which federal tax bracket you are in at the time of withdrawal. You have to pay taxes on the money you. Deposit checks on the go. Just snap a photo of a check with your phone or device to make deposits directly into your Fidelity Account. Generally, individuals must be at least 59 1/2 years old to withdraw funds penalty-free. The type of withdrawal, whether it be a hardship distribution or a. (Fidelity), to make the above withdrawal. • If this is a distribution from a Profit Sharing or. Self-Employed (k) Plan, you acknowledge that spousal. The most efficient way is to call Fidelity directly at You can speak to a representative that will guide you through the process of closing your. An early withdrawal penalty is assessed when a depositor withdraws funds from or closes out a time deposit before its maturity date. Early withdrawal. Unlike a (k) loan, the funds to do not need to be repaid. But you must pay taxes on the amount of the withdrawal. A hardship withdrawal can. Any cash you withdraw will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply. Also, your money won't have the. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Which accounts can I close online through the Virtual Assistant? As a starting point, Fidelity suggests you consider withdrawing no more than 4% to 5% from your savings in the first year of retirement, and then increase that. If you'd like to complete a cashout withdrawal of your (k) funds, select the option to "Request a cash distribution.” Note, this option will result in. To take a cash withdrawal from the Basic Retirement Plan: Contact TIAA () or Fidelity () to request a cash withdrawal or rollover. Withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty. Fidelity Brokerage. You will pay no additional taxes on either your Roth post-tax contributions or accumulated investment earnings as long as your withdrawal is after age 59½ and.

How To Select Brand Name

Use a business name generator · Create a mash-up · Appeal to your audience's interests · Pick a scalable business name · Consider acronyms · Beware of trends · Tell. How to Select Trademark, Service Name, Brand Name, Product Name? · Coined or 'fanciful' words. These are invented words without any intrinsic or real meaning. Determine your brand's values · Get to know your target market · Brainstorm potential brand names · Conduct a linguistic screening · Make sure your name is. Go shopping for your business name. If you need the perfect outfit, you visit your favorite store, right? It's easier and faster to select a great option from. Limit your name to two syllables, and keep it short. Avoid using any weird phrases, or hyphens, and make sure that you don't go so “clever” with your name that. When we talk about business, this saying gets full meaning. Choosing a company name can make a difference between business success and failure. As much as your. A good brand name is easy to pronounce, understand, and spell. Brand names should engender trust, not create uncertainty or confusion. To build a strong brand, it's important to choose a name that shows who you are as a company, what you stand for, and what you hope to achieve in the future. We have a set of comprehensive step-by-step tools to help you choose a great brand name for a product, service or business. Use a business name generator · Create a mash-up · Appeal to your audience's interests · Pick a scalable business name · Consider acronyms · Beware of trends · Tell. How to Select Trademark, Service Name, Brand Name, Product Name? · Coined or 'fanciful' words. These are invented words without any intrinsic or real meaning. Determine your brand's values · Get to know your target market · Brainstorm potential brand names · Conduct a linguistic screening · Make sure your name is. Go shopping for your business name. If you need the perfect outfit, you visit your favorite store, right? It's easier and faster to select a great option from. Limit your name to two syllables, and keep it short. Avoid using any weird phrases, or hyphens, and make sure that you don't go so “clever” with your name that. When we talk about business, this saying gets full meaning. Choosing a company name can make a difference between business success and failure. As much as your. A good brand name is easy to pronounce, understand, and spell. Brand names should engender trust, not create uncertainty or confusion. To build a strong brand, it's important to choose a name that shows who you are as a company, what you stand for, and what you hope to achieve in the future. We have a set of comprehensive step-by-step tools to help you choose a great brand name for a product, service or business.

When it comes to selecting a name for a brand, product, or service, trademark attorneys often take a different approach than most marketers. When it comes to choosing a business name there are some general guidelines to keep in mind. These include: Scalability: a name that. The information below outlines some of the legal requirements for corporation and LLC business names in New York. Choosing a Business Name: Legal Considerations. Consider who your target customers are and choose a name that makes them feel connected to your products or services. Secure your Domain. Once you have the. To be easily memorable, a brand name should ideally be two, three or maximum four syllables. Some brands are born with short, memorable names, such as Red Bull. Some branding experts recommend starting business names with a hard consonant or incorporating alliteration to make it more memorable. Keep it short. Choose a. The consumer associates the product name, label, and packaging with particular attributes such as value, quality, or tastefulness. A cough drop is just a cough. You can choose a brand name that is emotional, experiential, descriptive, elegant, or witty. Whatever you choose, a name should inspire a potent response from. A list of cool brands names by industry, to help you pick a winner for your business. Browse through our brand name for inspiration. It all starts with a Domain Name. Choosing the right domain name for your business, a startup, a new business, a new website, or a new blog can become one of. Alliterate; Use acronyms; Rhyme; Turn it into a pun; Abbreviate; Use symbolism; Personify your product. How do I choose a good business name? Brand identity. Your brand identity encompasses your business name and the visual elements that define your brand, from your logo and colors to the aesthetic of. Help me to select my brand name ; woodie3 · if we gotta pick the name, it may not be a good brand. trust your gut · 18 ; reignman · Morenchi · 5. The downside of a descriptive brand name is that it can hamstring your business as you grow and look to diversify. While they are functional and utilitarian for. Registration of brand name or logo registration is necessary to protect the goodwill and reputation of one's business from competitors. To generate a good or catchy business name, you need to consider the following: What does your business offer? What is your USP or unique selling point? Who's. Business Name Generator · Brainstorm ideas. Enter keywords or pick from a list of abstract ideas, then let the creation process begin! · Check availability. The journey of launching a successful product-based business is full of hurdles, but also immense rewards. One of the most important elements is the naming. How to choose the right name for your business · 1. Brainstorm your brand values. · 2. Ask customers what they think. · 3. See whether your name is available. · 4. To generate a good or catchy business name, you need to consider the following: What does your business offer? What is your USP or unique selling point? Who's.

How Can I Borrow Against My Life Insurance Policy

You cannot, as they only sell term insurance. Term insurance does not have any cash value which would be needed in order to borrow from the. Policy loans: Almost all whole policies permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest. Life insurance policy loans allow you to borrow money from the insurance company using your policy's death benefit and cash value as collateral. A whole life insurance policy line of credit may be the liquidity you need · Lines range from $70, to $5,, · No application fee, closing costs, or pre-. You can generally borrow money from your life insurance policy once the cash value component has met a certain minimum threshold. Cash Value: You can only borrow against the available cash value in your policy. Interest Accrual: Unpaid interest can reduce your death benefit. Next Steps. You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-like. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. Aflac offers whole life insurance with cash value that you can borrow against in the form of a loan. These life insurance loans can help pay for medical. You cannot, as they only sell term insurance. Term insurance does not have any cash value which would be needed in order to borrow from the. Policy loans: Almost all whole policies permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest. Life insurance policy loans allow you to borrow money from the insurance company using your policy's death benefit and cash value as collateral. A whole life insurance policy line of credit may be the liquidity you need · Lines range from $70, to $5,, · No application fee, closing costs, or pre-. You can generally borrow money from your life insurance policy once the cash value component has met a certain minimum threshold. Cash Value: You can only borrow against the available cash value in your policy. Interest Accrual: Unpaid interest can reduce your death benefit. Next Steps. You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-like. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. Aflac offers whole life insurance with cash value that you can borrow against in the form of a loan. These life insurance loans can help pay for medical.

A life insurance loan can be a great way to access your cash while still earning interest and dividends on your full savings. Yes, you can get a loan taken out on your policy, but it does reduce the death benefit available to your loved ones should you pass before the loan is paid back. The ultimate method for borrowing money from your policy is by taking out a loan. But we need to unpack some things here. You can only borrow against a permanent life insurance policy, meaning either a whole life insurance or universal life insurance policy. You can generally borrow money from your life insurance policy once the cash value component has met a certain minimum threshold. You can borrow money against permanent life insurance policies that have cash value. Some types of permanent policies you can borrow from include whole life. A Living Benefit Loan makes it possible for you to receive up to 50% of your life insurance policy's death benefit today by borrowing against your life. You can borrow at any time if the policy loans accrue interest. Can I withdraw or surrender money from my life insurance? You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that policy loans and. Can I borrow against my life insurance? Can I borrow against my life insurance? If you have a participating life insurance policy, you can borrow against its. Yes. Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most. Yes. Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners. You can borrow money from a permanent life insurance policy once the cash value has built up to the borrowing threshold. Simply reach out to your insurance provider and ask them about the process. On the other hand, if you are thinking about getting life insurance and want to. Key Takeaways · Borrowing from your life insurance policy is one option to access money to pay for a major expense or necessity. · You can borrow from your life. Borrow against the policy You can often take out a loan with the cash value of your life insurance policy as collateral. With any loan, however, you'll be. Depending on what type of life insurance policy you have, the loan can even be tax-free, unlike simply withdrawing money from the policy. Thus, anyone can always borrow money against his or her whole life policy as long as the person has some accumulated cash on it. Borrowed money can be spent on. Please be advised that a loan against your universal life policy may cause the policy to lapse if it is not adequately funded. As well, this transaction may.

Management Of Funds

ESMA is active in the area of collective investment management, commonly known as fund management. The fund management sector covers different types of. If you're looking for better rates of return on deposits than you'd get in an ordinary bank account, cash funds may be an option to consider. They often invest. Funds management can be simply explained as the task of managing a pool of money on behalf of others, with the aim of maximising the amount it grows by. Funds. Delegation of Investment Management to Affiliates. Products upon which composite results contained in this material, if any, are based may not. Track the performance of your stocks, mutual funds, and other investments with Fund Manager, portfolio management software. Katten advises many of the world's premier domestic and offshore private investment funds, alternative investment managers, investment advisers. In this industry, there are two methods to manage the funds. One is known as the “Passive Management” method while the other is the “Active or Positive. Background. The Secretary of the U.S. Treasury is designated by law as the managing trustee for 18 of the approximately federal investment funds. With more. In the context of channel partnerships, fund management refers to how you manage and distribute any funds related to your partner ecosystem. It's an essential. ESMA is active in the area of collective investment management, commonly known as fund management. The fund management sector covers different types of. If you're looking for better rates of return on deposits than you'd get in an ordinary bank account, cash funds may be an option to consider. They often invest. Funds management can be simply explained as the task of managing a pool of money on behalf of others, with the aim of maximising the amount it grows by. Funds. Delegation of Investment Management to Affiliates. Products upon which composite results contained in this material, if any, are based may not. Track the performance of your stocks, mutual funds, and other investments with Fund Manager, portfolio management software. Katten advises many of the world's premier domestic and offshore private investment funds, alternative investment managers, investment advisers. In this industry, there are two methods to manage the funds. One is known as the “Passive Management” method while the other is the “Active or Positive. Background. The Secretary of the U.S. Treasury is designated by law as the managing trustee for 18 of the approximately federal investment funds. With more. In the context of channel partnerships, fund management refers to how you manage and distribute any funds related to your partner ecosystem. It's an essential.

Shaping the future of alternative asset management. As the authoritative voice of the industry and premier platform for networking and training, MFA delivers. You can set up fixed funds for a customer, a customer-category combination, or a customer-brand combination. To set up fixed funds, first create a fund template. Our mission is to provide solutions that cater to the unique needs of public sector entities. We offer comprehensive investment solutions for operating funds. Any discrepancies in the Cash Fund balance must be investigated and resolved. Cash Funds are a loan, therefore, in the event of a loss the fund must be. Fund Management companies take charge of all activities relating to the day-to-day operation of investment funds. This includes overseeing the investment. Funds management is the professional management of a pool of assets by an investment specialist known as a fund manager. This is generally on behalf of. Fenimore Asset Management, manager of the FAM Funds, is a trusted investment partner serving investors and financial institutions locally and nationally. Funds management is the management of the cashflow of a financial institution. The funds manager ensures that the maturity schedules of the. Wellington Management is one of the world's leading independent asset managers. funds and private investment strategies. Learn more. Private. (1) Affiliates of Ares Management Corporation serve as investment advisers to our publicly traded funds. Securities offered through Ares Management Capital. Funds management involves estimating liquidity requirements and meeting those needs in a cost-effective way. Effective funds management involves management. Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate. Assets Under Management vs Fund Under Management In the financial industries, if something is described as “under management” this refers to an asset or fund. Large Cap Growth Fund. Invest in America's biggest and best. Targeting companies with large markets, sustainable competitive advantages and strong price. Comprehensive coverage of fund and asset management. The latest news and top stories on investment opportunities and risks, asset decisions and regulatory. Fund management refers to the systematic process in which a fund manager operates, deploys, maintains, disposes, and cost-effectively upgrades assets. At the. Our funds are informed by global investment research addressing the demands of the ever-changing financial landscape. Every investor has unique needs and Lazard. In general terms, active management refers to mutual funds that are actively managed by a portfolio manager. Passive management typically refers to funds that. Funds Management · Responsibility for University Financial Assets · University Funds · Expenditure Accounts (PTAs) · Cost Policy. Our investment management and funds lawyers deliver high-quality work and provide clients with unparalleled insight into market terms and conditions.

Fair Credit Rating Credit Cards

Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. Best credit cards for fair/average credit in September · + Show Summary · Capital One Platinum Credit Card · Discover it® Student Cash Back. If your credit score is between to it's likely to be considered very good. A credit score of and above is generally considered to be an excellent. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. The Current Build Card is a no annual fee secured card that builds credit while earning up to 7X points and 4% APY on savings. Easily compare and apply online for Fair credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. Credit cards for fair credit target consumers with FICO scores between and These cards lack the splashy rewards of credit cards for good or excellent. Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. Best credit cards for fair/average credit in September · + Show Summary · Capital One Platinum Credit Card · Discover it® Student Cash Back. If your credit score is between to it's likely to be considered very good. A credit score of and above is generally considered to be an excellent. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. The Current Build Card is a no annual fee secured card that builds credit while earning up to 7X points and 4% APY on savings. Easily compare and apply online for Fair credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. Credit cards for fair credit target consumers with FICO scores between and These cards lack the splashy rewards of credit cards for good or excellent.

Credit Cards for Fair Credit · Find The Card for You · Imagine® Visa® Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card · First Digital Mastercard®. A credit score is considered fair as it falls between the ranges of through Discover what you can do with a credit score and ways to help. A closer look at the best credit cards for those with fair credit score · Capital One QuicksilverOne Cash Rewards Credit Card · Discover it Student Cash Back. Having fair credit means your credit score falls within a specific range, between and for FICO scores. People with fair credit may struggle to qualify. Compare top offers of for credit cards for fair credit. Compare cards with features like cash back, fraud coverage, or no annual fee. What is a fair and average credit score? · Subprime: to · Near prime: to · Prime: to · Superprime: to Key Takeaways If you have a fair credit score, your FICO score is between and Overall, FICO scores range from to The average score in the. The best credit cards for fair credit hit the sweet spot between being easy to get and offering great perks. The Capital One Platinum Credit Card is our top. The Canadian Tire Mastercard is a good store card you can use to earn rewards while boosting your Canadian credit score. It's one of the easier secured credit. Credit Cards for Fair Credit · Our pick for doubling your cash back · Highlights - Citi Double Cash® Card · Highlights - Milestone Mastercard® · Highlights - Surge®. If you have fair credit, the Capital One Platinum card is our top pick due to its limited fees, ability to increase your credit limit and more. The base FICO® Scores range from to , and a good credit score is between and within that range. FICO creates different types of consumer credit. Credit Cards for Fair Credit · Our pick for doubling your cash back · Highlights - Citi Double Cash® Card · Highlights - Milestone Mastercard® · Highlights - Surge®. Having difficulty getting approved for a credit card? The Avant Credit Card may be an option if you have a fair or average credit score. SEE IF YOU QUALIFY. That being said, scores starting in the high s and up to the mids (on a scale of to ) are generally considered to be good. How a good credit score. About Fair Credit Cards · What is fair credit? At Credit Sesame, a fair credit score is typically between – · What can you expect in a credit card for. About Fair Credit Cards · What is fair credit? At Credit Sesame, a fair credit score is typically between – · What can you expect in a credit card for. scores), a credit score falls within the “fair” range. So, what does cards, loans, and a mortgage, can positively impact your credit score. Key Takeaways If you have a fair credit score, your FICO score is between and Overall, FICO scores range from to The average score in the. Why this is one of the best cards for good credit: The Capital One SavorOne Cash Rewards Credit Card requires a credit score of or higher to qualify. With.

1 2 3 4 5